Simple. Efficient. Fair

All you or your client need

to do is give us a call.

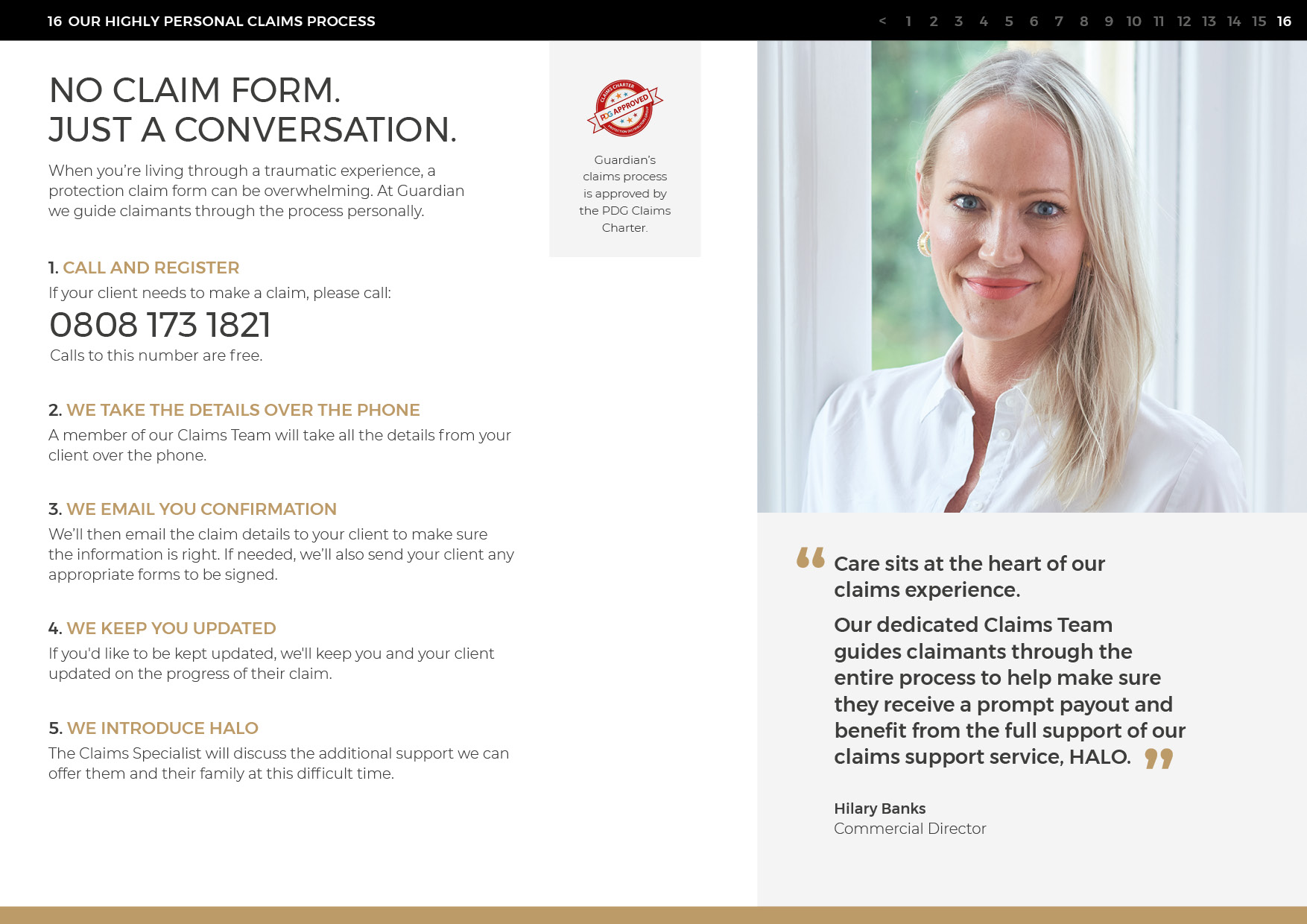

How to make a claim

-

Call and register

If your client needs to make a claim, please call:

0808 173 1821

Calls to this number are free. -

We take the details over the phone

A member of our Claims Team will take all the details from your client over the phone.

-

We email your client confirmation

We’ll then email the claim details to your client to make sure the information is right. If needed, we’ll also send your client any appropriate forms to be signed.

-

We keep your client updated

If you’d like to be kept updated, we’ll keep you and your client updated on the progress of their claim.

-

We introduce halo

The Claims Specialist will discuss the additional support we can offer them and their family at this difficult time.

Browse our 2024 CLAIMS REPORT

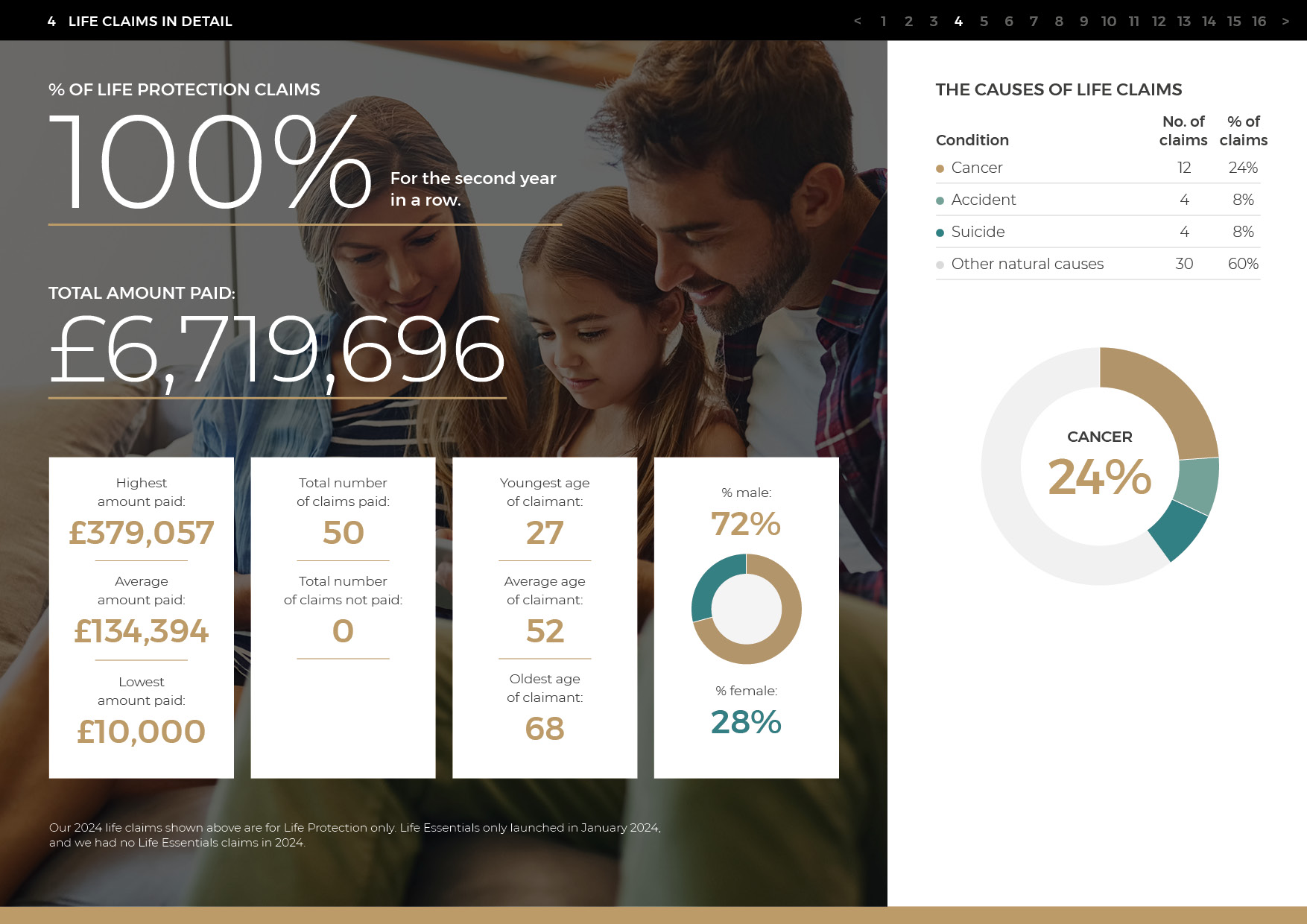

Our second year in a row of paying 100% of life claims

the 2024 stats not to be missed

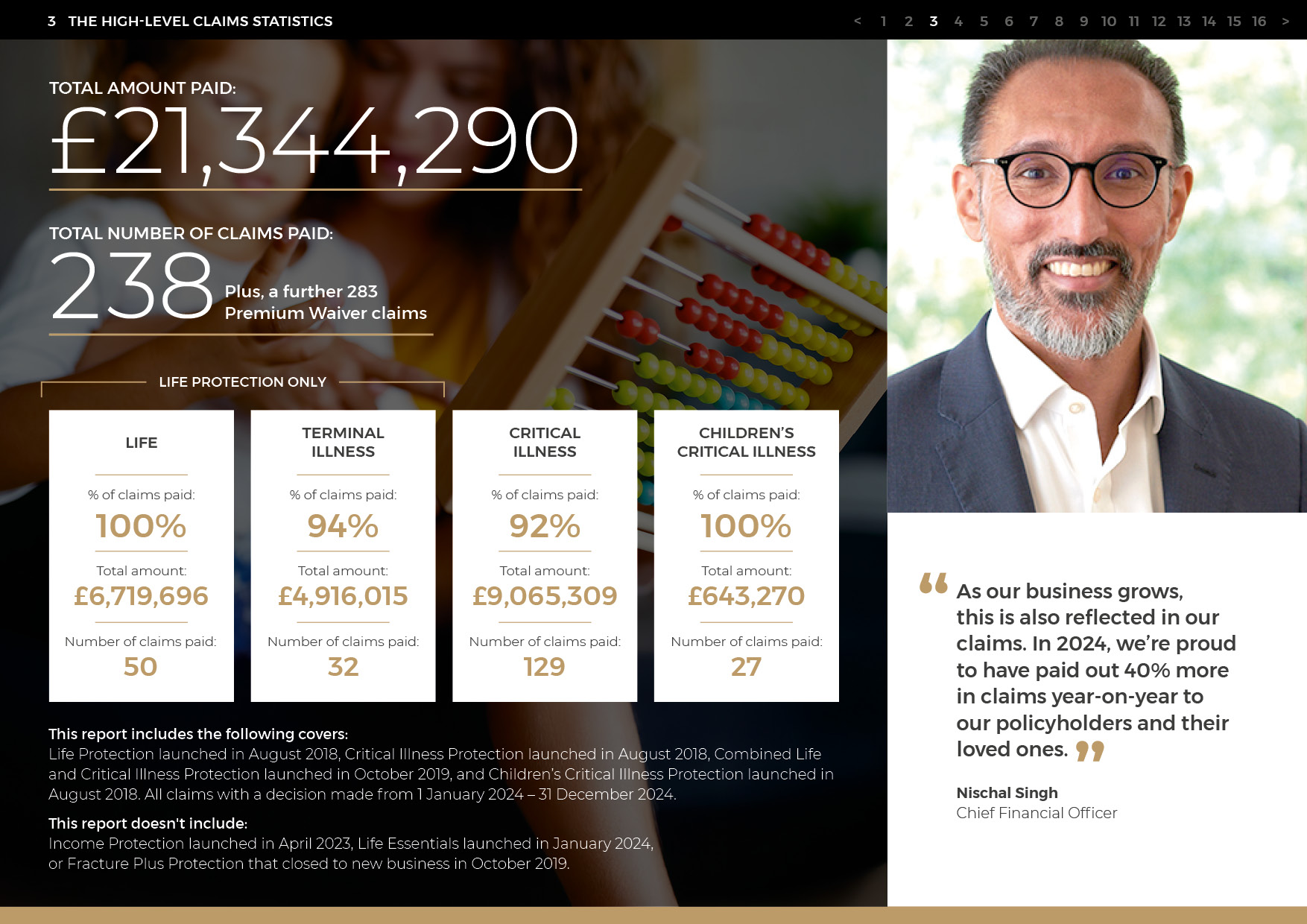

TOTAL AMOUNT PAID:

£21,344,290

LIFE

% of claims paid

100%

Total amount:

£6,719,696

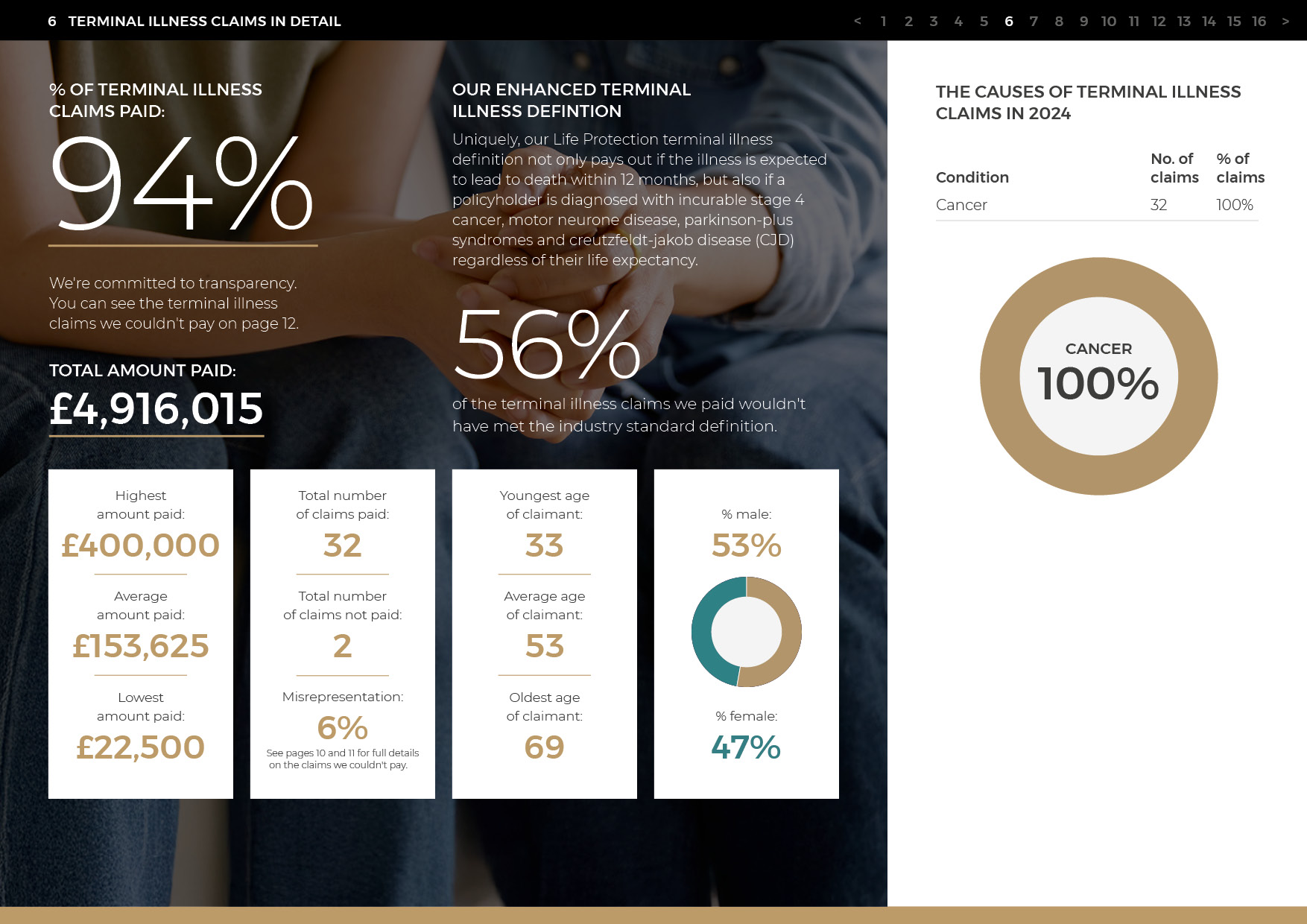

TERMINAL ILLNESS

% of claims paid

94%

Total amount:

£4,916,015

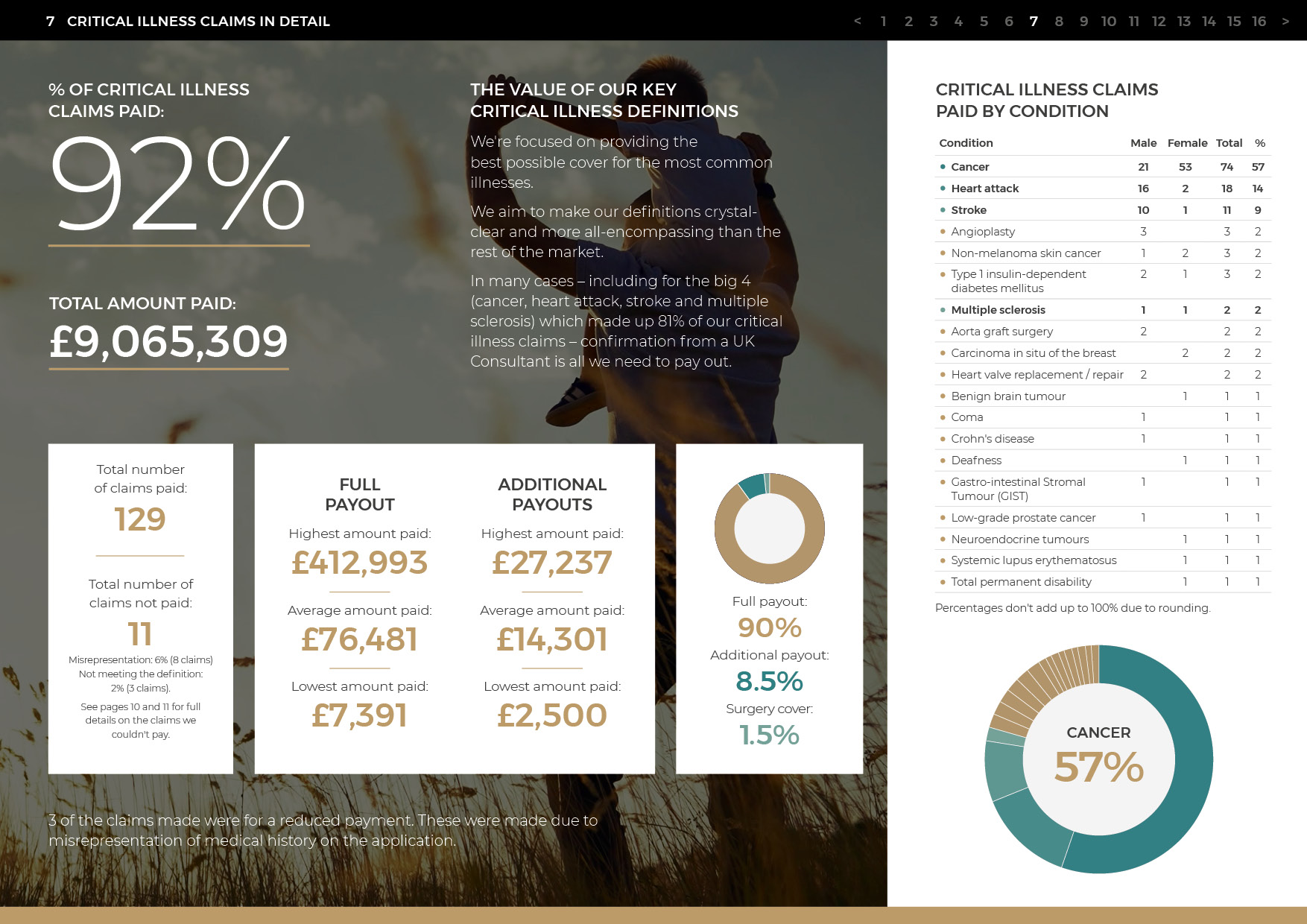

CRITICAL

ILLNESS

% of claims paid

92%

Total amount:

£9,065,309

CHILDREN’S

CRITICAL ILLNESS

% of claims paid

100%

Total amount:

£643,270

The claims experience

The following customer stories are testament to quality of the claims experience we provide. Every adviser and customer who chooses Guardian can expect nothing less.

I can’t fault the whole process at all. It’s been

smooth from the start to finish, and I was

made to feel that I could get in touch

with Sue anytime to ask questions.

James

A Guardian Critical Illness Protection policyholder

Guardian were brilliant. They were

on my side from the moment my

adviser registered the claim.

Lesley-Ann

A Guardian Critical Illness Protection policyholder

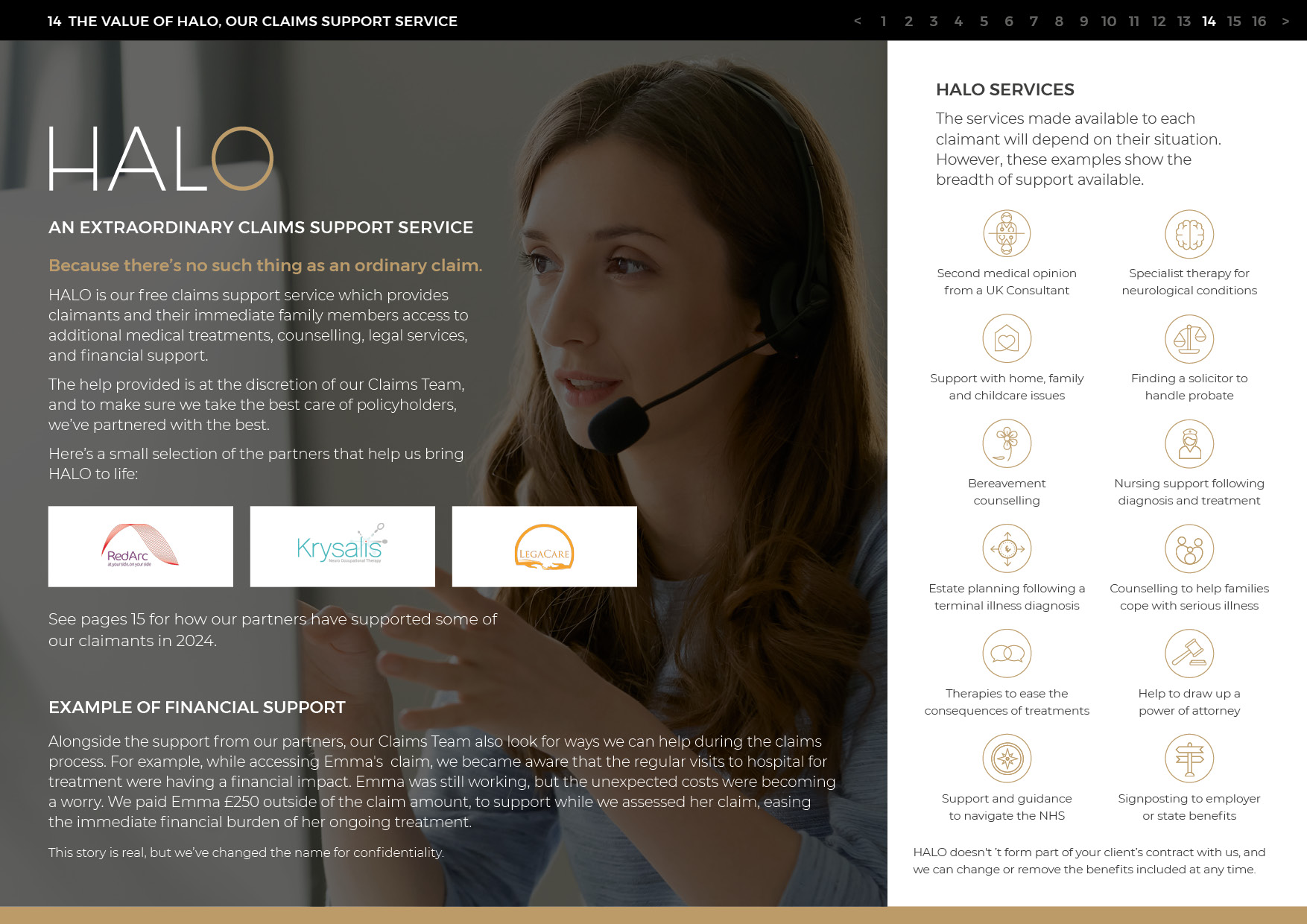

A halo case study

When Marilyn was diagnosed with breast cancer after a routine mammogram, HALO made sure she didn’t face treatment alone.

PDG CLAIMS CHARTER APPROVED

There’s more to claims than just paying them on time. Support and an efficient experience are just as important during a claim.

At Guardian, we have a dedicated claims team, with each claimant receiving a named point of contact who’ll provide regular updates, support and answer any questions as the claim progresses. Which is why Guardian’s claims process is approved by the PDG Claims Charter.

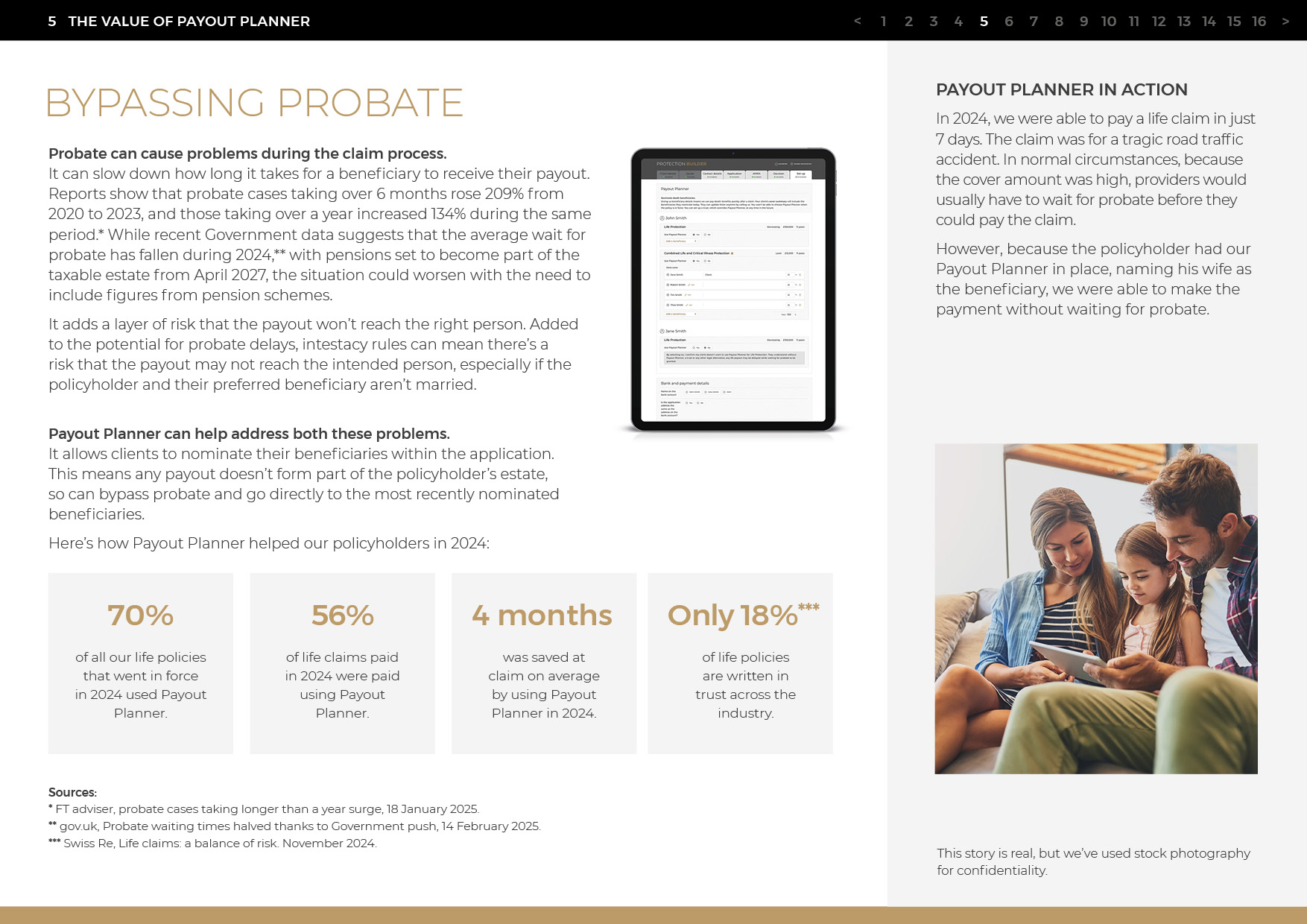

OUR PLEDGE TO PAY FUNERAL COSTS

While we always try to pay claims quickly, sometimes probate can prevent the money from reaching the family for several months depending on the complexities of the estate.

So, if we’re still awaiting probate once a life claim has been approved for payment, we’ll pay part of that life claim early by advancing up to £10,000 to help the bereaved family cover the cost of the funeral. To show our commitment to this we’ve signed up to the PDG Funeral Payment Pledge.

AT THE POINT OF CLAIM

An extraordinary service, because there’s

no such thing as an ordinary claim.

simplicity is at the heart

of our claims experience.we guide claimants through

the entire process to help

ensure they receive a prompt

payout and benefit from the

full support of halo.

Caroline Froude

Head of Underwriting and

Claims Strategy and Development