The easy way to bypass probate.

Probate can take up to 11 months*. Just imagine a grieving family having to wait that long for a life insurance payout. Or, even worse, losing the money under intestacy rules.

Source: *UK Parliament, Justice Committee launches new inquiry into probate amid concerns over delays and consumer protection, November 2023

PAYOUT PLANNER. WHAT’S THE BIG IDEA?

Payout Planner lets clients nominate up to 9 beneficiaries when applying. If Payout Planner has been used and the policyholder dies, the money is payable to the beneficiaries under contract law.

This means any payout doesn’t form part of the policyholder’s estate and isn’t subject to inheritance tax (IHT), so payouts bypass probate and go directly to the most recently nominated beneficiaries.

SETTING UP PAYOUT PLANNER

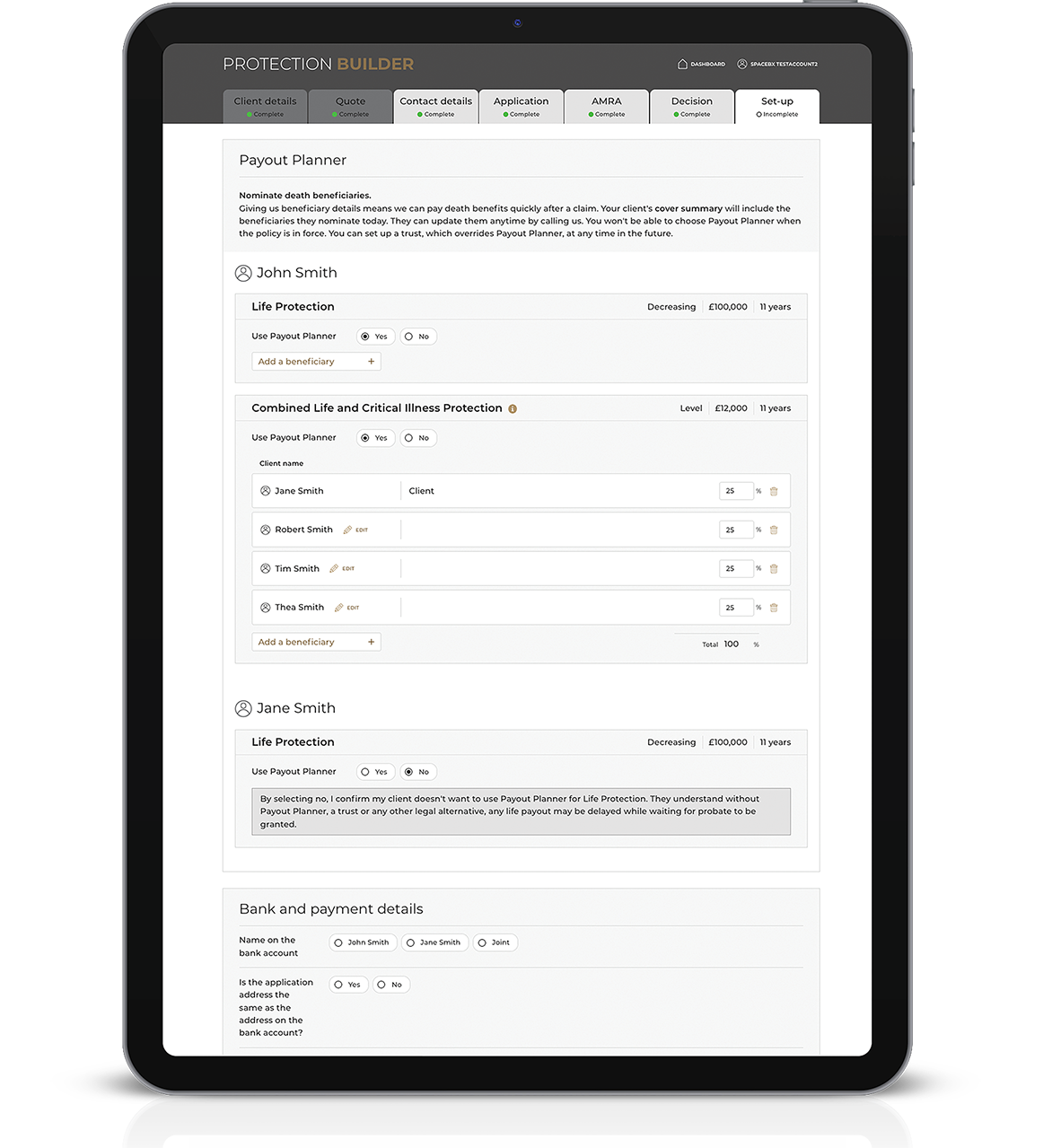

Step 1

You can use Payout Planner by clicking ‘yes’ under any life covers on the application, in the Set-up tab.

Step 2

To nominate a beneficiary, click ‘Add a beneficiary’ in the relevant cover box and enter their details and the % of any payout they should receive.

Step 3

To nominate further beneficiaries, click ‘New beneficiary’ and enter their details. All % allocations must add up to 100%.

KEY POINTS TO NOTE

Contract law

Beneficiaries must be nominated at the point of application so the money is payable to the beneficiaries under contract law.

Setting up a Trust

Any trust set up in the future will supersede Payout Planner. So you can still use Payout Planner even if you plan to set up a trust later.

Changing beneficiaries

Policyholders can change beneficiaries or their shares simply by calling or emailing us.

Terminal Illness payouts

Terminal Illness payouts are kept outside Payout Planner and will be paid to the policyholder.

THE RESULT

68% OF ALL OUR LIFE POLICIES ARE UNDER PAYOUT PLANNER1

74% OF LIFE CLAIMS PAID IN 2023 WERE PAID USING PAYOUT PLANNER2

LIFE CLAIMS PAID FASTER!

Sources:

1: Guardian Payout Planner usage (5 years), 1 January 2019 – 31 December 2023.

2: Guardian claims statistics, 1 January 2023 -31 December 2023.

All OUR LIFE COVERS

Payout Planner can be set up for our premier Life Protection, our low-cost Life Essentials and the life element of Combined Life and Critical Illness Protection.

Clients can choose different beneficiaries for each other.

THE KEY QUESTIONS, ANSWERED

-

Clients can nominate people, or organisations such as a charity.

-

Clients can’t nominate themselves, their estate, a trust they (or their estate) benefit from or their creditors.

-

Clients can’t receive any money or benefit from a nominee in exchange for a nomination.

-

If clients have applied for mortgage protection, they can’t nominate the mortgage lender, but they can nominate the person who would be responsible for taking over the mortgage payments. In the case of a joint mortgage, this would normally be the other party to the mortgage.

-

If your client has applied for more than one type of cover, say Level and Decreasing Cover, they can choose separate beneficiaries for each payout.

-

If any of the current beneficiaries are children under 18, we’ll pay each child’s share to their parent or guardian. The parent or guardian is responsible for making sure any cover amount paid to them is held until each child becomes an adult (this is usually achieved by setting up a trustee bank or savings account for each child) or used for the child’s benefit.

-

If any of the beneficiaries have died, we’ll pay their share to their estate, so it’s best if your client changes their nomination to avoid delays or an unintended result.

-

If the policy has subsequently been put in trust, this will take precedence over Payout Planner, and we’ll pay in line with the trust.

Clients can change their beneficiaries anytime by contacting us by email or phone. Once they’ve confirmed their identity and any change to the beneficiaries or their allocation entitlements, we’ll update our system and issue a new cover summary to their MyGuardian account.

We recommend clients review their beneficiaries every year to make sure their choice is still appropriate and details are up to date. They can see who they’ve nominated on their cover summary in their MyGuardian account.

Payout Planner is suitable for clients with simple affairs who don’t need to set up a trust. For those with complex estates or particular inheritance tax planning needs, a trust may be more suitable.

Yes, Payout Planner can be set up for Life Protection, Life Essentials and the life element of Combined Life and Critical Illness Protection.

Clients can choose different beneficiaries for each cover.

If the client is eligible for an immediate cover claim and Payout Planner has been used, we’ll pay out to their named beneficiaries.

Find out more about Immediate Cover here: https://adviser.guardian1821.co.uk/immediate-cover/

For full details of Payout Planner, view our policy terms and conditions.

FAMILIES DON’T NEED TO GAMBLE ON HOW LONG LIFE COVER PAYOUTS TAKE TO FIND THEIR WAY OUT OF PROBATE.

PAYOUT PLANNER GIVES EVERY LIFE COVER POLICYHOLDER A SIMPLE WAY TO MAKE SURE THE MONEY REACHES THEIR LOVED ONES AND FAST.

Hilary Banks

Commercial Director