Reason to recommend

No.2

CRITICAL ILLNESS

DEFINITIONS

Crystal clear policy wording that provides quicker payouts.

What makes our approach better

Our definitions are written to make sure people who claim are treated fairly and payouts are received with the minimum of questions asked.

Prostate cancer

Additional payout for patients placed under observation

Unlike some other providers who only pay out if the customer needs surgery or treatment, we pay out an additional 50% of the cover amount up to a maximum of £50,000 if they’re diagnosed with a Gleason score of between 2 and 6 (inclusive) and just placed under observation. Which happens in most cases.

What’s more, if the cancer progresses and the Gleason score increases to 7 or above, we’ll make a further payout of the full cover amount.

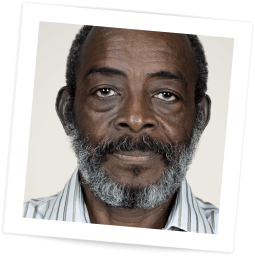

Read Bembe’s story to fully understand

the value of our prostate cancer definition.

Malignant skin cancer

Additional payout following low-risk diagnosis

While other providers won’t pay out for low-risk non-melanoma skin cancers, we’ll pay out 10% of the cover amount up to a maximum of £50,000. We’ll also pay out 50% of the cover amount up to a maximum of £50,000 for high-risk non-melanoma skin cancers.

What’s more, if the skin cancer reoccurs and develops to meet our definition for a full payout, we’ll make a further payout of the full cover amount.

Read Jane’s story to fully understand the

value of our malignant cancer definition.

Angioplasty

Additional payout for patients needing a single stent

While some other providers won’t pay out unless a customer’s angioplasty includes the fitting of two stents, we’ll pay out an additional 50% of the cover amount up to a maximum of £50,000 if they need just one.

What’s more, the customer remains fully covered which means that if they become critically ill in the future, we’ll make a further payout of the full cover amount.

Read Tom’s story to fully understand the value of our angioplasty definition.

Stroke

A simple and fast claims assessment

With a Guardian policy, if symptoms have lasted for more than 24 hours and a UK Consultant Neurologist says it’s a stroke, we pay out.

Heart attack

The word of a UK consultant is all we need to pay out

If a UK Consultant confirms that there is death of heart due to inadequate blood supply, that has resulted in a heart attack, we pay out.

Multiple sclerosis

No need to have symptoms at point of claim

There’s no guarantee a person will have symptoms when they’re first diagnosed as they come and go – especially in the early stages.

That’s why we pay out if a UK Consultant Neurologist says there ‘has been’ an impairment due to multiple sclerosis – even if the symptoms are not apparent when they make the claim.

Critical Illness definitions

View our Critical Illness Protection definitions in detail

REGISTER FOR A PRODUCT BRIEFING

To find out more about Guardian, join us at our next monthly product briefing with one of our experts.

Our webinars are designed for you to learn more about Guardian and give you hints and tips to grow your protection sales. All our live webinars qualify for CPD.