Skin Cancer

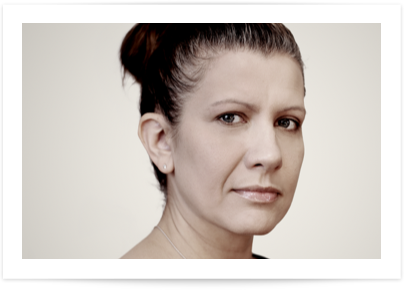

Jane CAUGHT HER

NON-MELANOMA SKIN CANCER TOO EARLY

FOR HER POLICY TO PAY OUT

Fortunately, Jane’s skin cancer was caught early so her Consultant thinks the tumour on her back can be removed. But…

Jane’s critical illness policy won’t pay out. Apparently, early-stage skin cancer is not covered.

However, given that she needs surgery and there’s a small chance the cancer might spread, it still feels critical to Jane.

Jane is not alone

188,000

NEW CASES OF NON-MELANOMA SKIN CANCER ARE DIAGNOSED EACH YEAR IN THE UK

Source: Cancer Research UK, April 2024.

THAT’S WHY, AT GUARDIAN, WE DO THINGS DIFFERENTLY

While other providers won’t pay out for low-risk non-melanoma skin cancers, we’ll pay out 10% of the cover amount up to a maximum of £50,000.

We’ll also pay out 50% of the cover amount up to a maximum of £50,000 for high-risk non-melanoma skin cancers.

What’s more, if the skin cancer reoccurs and develops to meet our definition for a full payout, we’ll make a further payout of the full cover amount.

What else you need to know

REGISTER FOR A PRODUCT BRIEFING

To find out more about Guardian, join us at our next monthly product briefing with one of our experts.

Our webinars are designed for you to learn more about Guardian and give you hints and tips to grow your protection sales. All our live webinars qualify for CPD.