2 March 2026

Show the value of protection

Wealth advisers spend their days helping clients manage and grow their assets. It’s not always immediately obvious where protection comes in, but it plays an important role.

Without adequate protection, a client’s financial plans can be at risk if there are unexpected life events or shocks, such as losing income due to injury or critical illness. How long will their wealth last without the income they’re expecting to top up their pensions or investments?

Tools like cash flow forecasting can help bring this to life. You’re already using this is part of your client conversations for pensions and investments, but have you considered using it to support your protection conversations?

How cash flow tools can help

Run a normal scenario for clients in the way you normally would with their pension and investment planning. Then run another scenario where the client has an event or shock (e.g. a critical illness) and is unable to work from that point onwards to retirement.

Comparing the 2 scenarios with your clients helps highlight the importance of having enough protection to keep their plan on track and maintain the lifestyle they’re targeting through retirement.

Let’s look at an example: Derek and Clare

Derek works as an Accountant and Clare is a nurse.

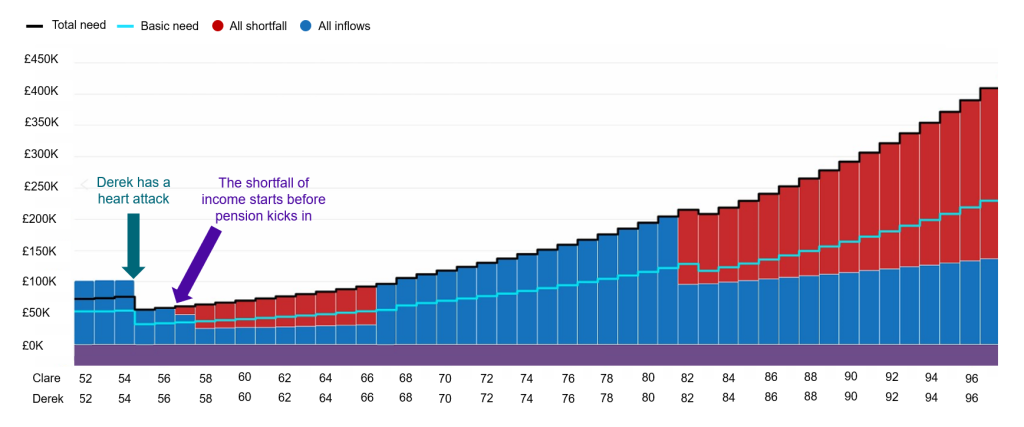

In chart 1, you can see with Derek’s income from ages 52-54, Derek and Clare have enough money to cover their total outgoings (the black line in chart 1). Total outgoings are their basic needs such as mortgage and bills, but also the lifestyle they’re used to including holidays, eating out and a new car every 2 years.

At 54, Derek has a heart attack and has to stop working. Their joint income is reduced. Shown in the drop of the blue bars in chart 1 at age 54.

The chart shows that for the first few years after Derek’s heart attack, they’re fine, and their savings can cover their total needs (black line) and their basic needs (blue line). But their savings don’t last long. After age 57, there’s a shortfall in their income until he’s 66 when their pension kicks in. This shortfall means not only will the lifestyle they’ve worked so hard for be impacted, but they may also struggle to meet their basic needs.

Chart 1: Clare and Derek’s cash flow without critical illness cover

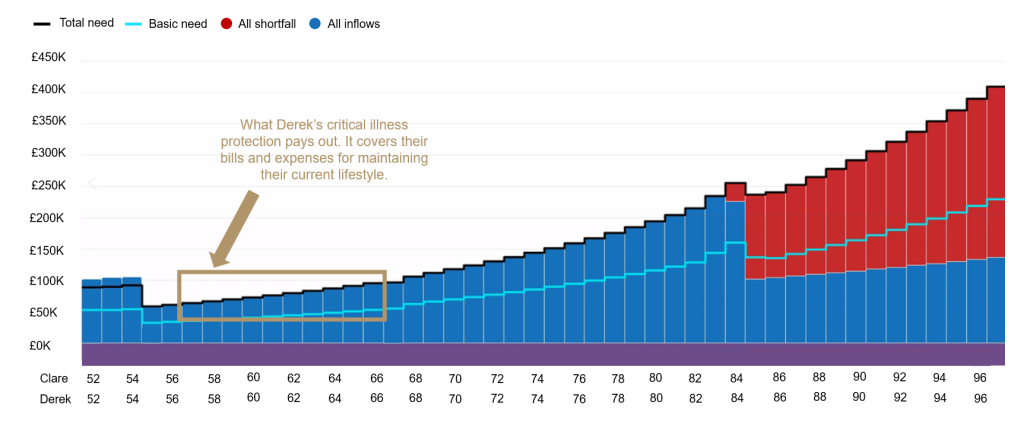

Chart 2: Clare and Derek’s cash flow with critical illness cover

If Derek has critical illness protection, it’s much better. As you can see from the graph below, even with the reduced income, they can still maintain their total needs – while there is still an impact on their retirement plan, it’s much less than it would be without a protection policy in place.

Seeing the scenarios laid out in this way can help clients make informed decisions about what they need and highlight the impact on the retirement they have worked so hard for without having protection policy in place. It’s also a useful way to show you’re helping them prevent foreseeable harm.

Derek and Clare are fictitious characters, and their story has been created for illustrative purposes only of how cash flow forecasting tools could be used in your protection conversations. Each client’s situation is different, and their protection needs and retirement goals are different. You need to tailor your advice to their own situation and retirement goals.

Find out more about Guardian’s Critical Illness Protection and Income Protection here: Our products – Guardian Adviser