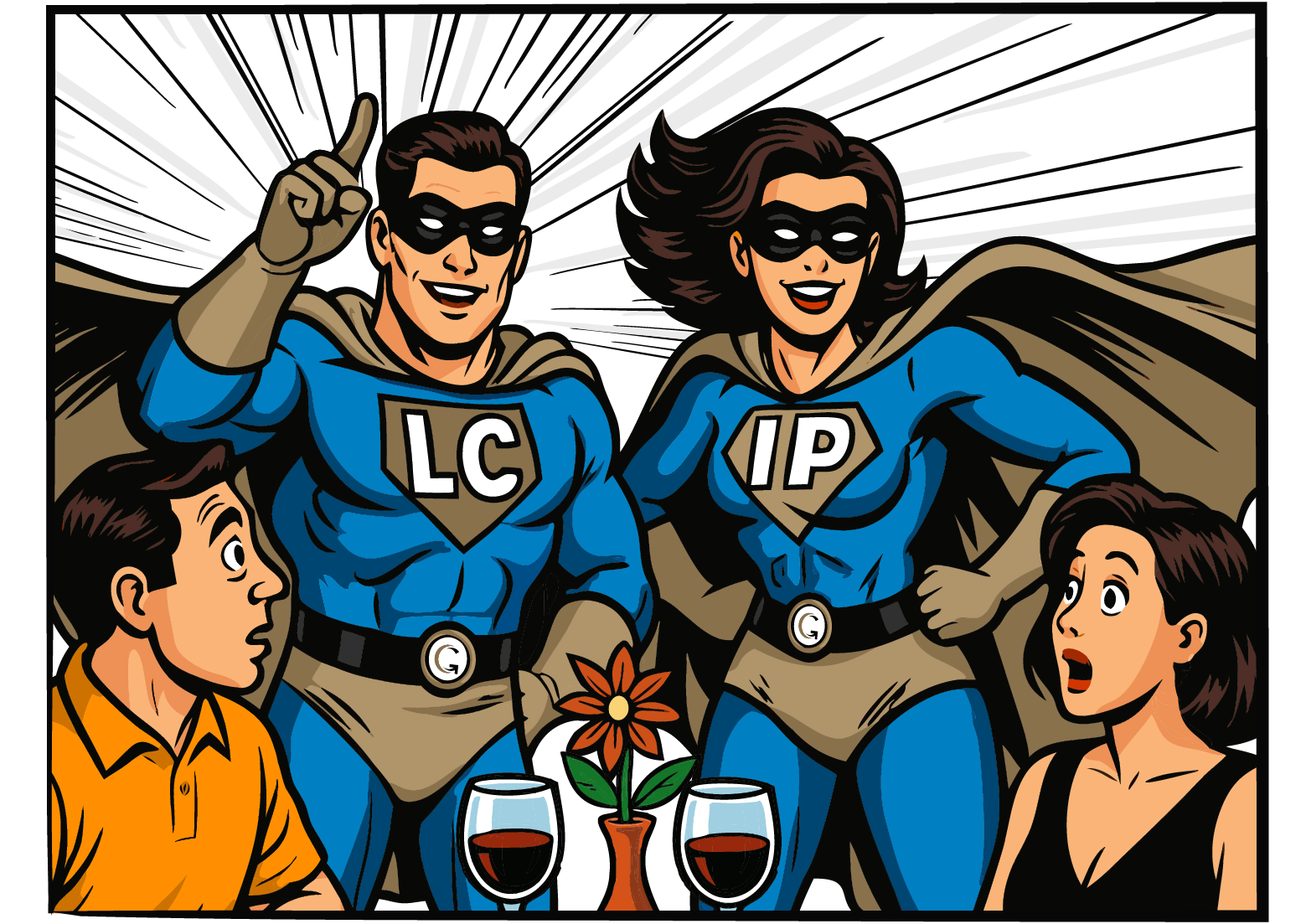

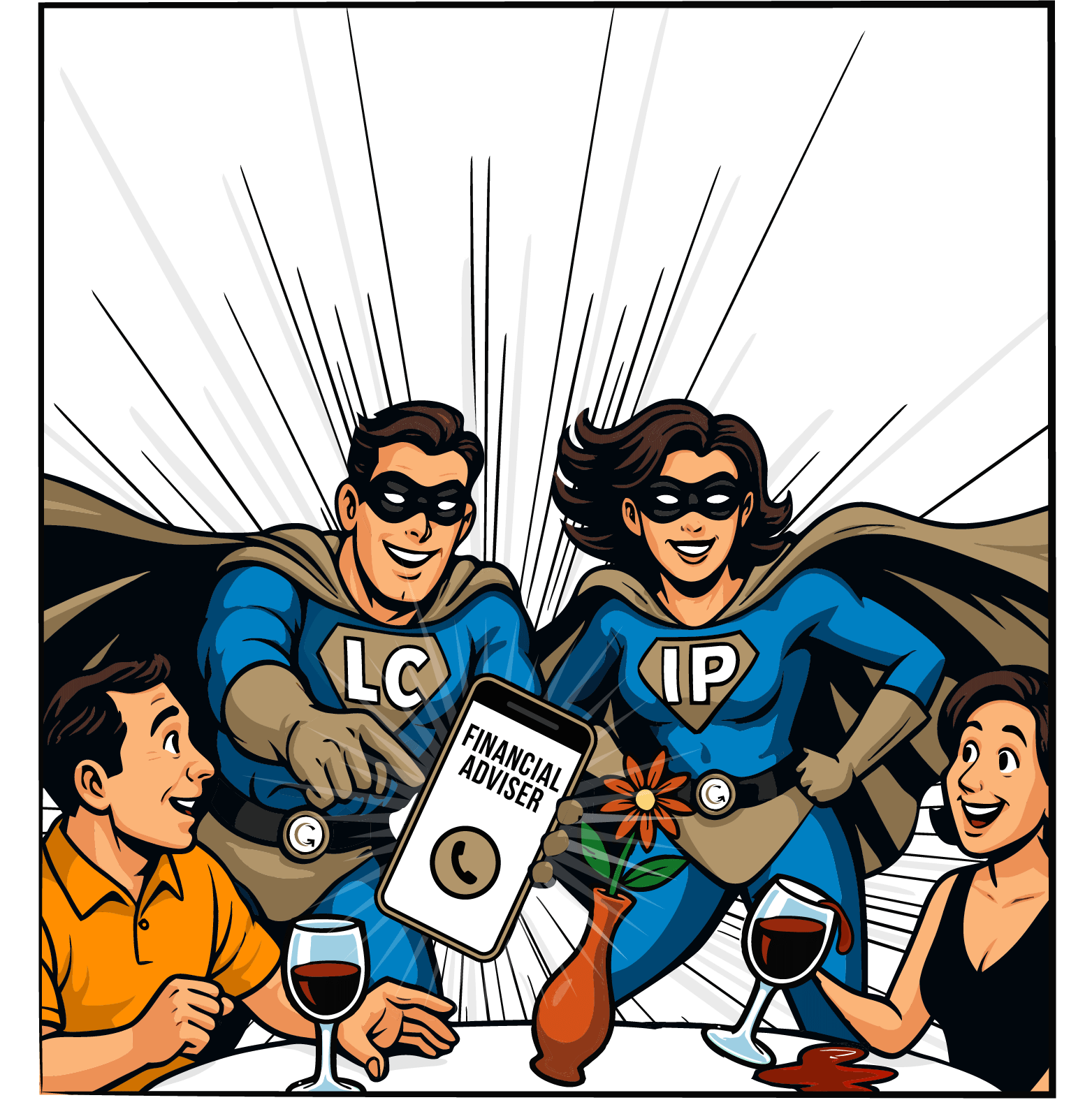

Our heroes, Life Cover and Income Protection, continue to work together to protect people from the financial perils that Death and Illness leave in their wake.

Death is prepared to strike anyone at any time.

The average age of a life claimant in 2024 was 52 and the youngest was just 27 1.

Illness is ONE OF THE BIGGEST RISKS to financial security.

7% of the working-age population are economically inactive because of long-term sickness 2.

1 Guardian 2024 claims report. All claims with a decision made from 1 January 2024 – 31 December 2024.

2 Economic update: inactivity due to illness reaches record, UK Parliament. April 2024.

Our heroes, Life Cover and Income Protection, continue to work together to protect people from the financial perils that Death and Illness leave in their wake.

Death is prepared to strike anyone at any time.

The average age of a life claimant in 2024 was 52 and the youngest was just 27 1.

Illness is ONE OF THE BIGGEST RISKS to financial security.

7% of the working-age population are economically inactive because of long-term sickness 2.

1 Guardian 2024 claims report. All claims with a decision made from 1 January 2024 – 31 December 2024.

2 Economic update: inactivity due to illness reaches record, UK Parliament. April 2024.

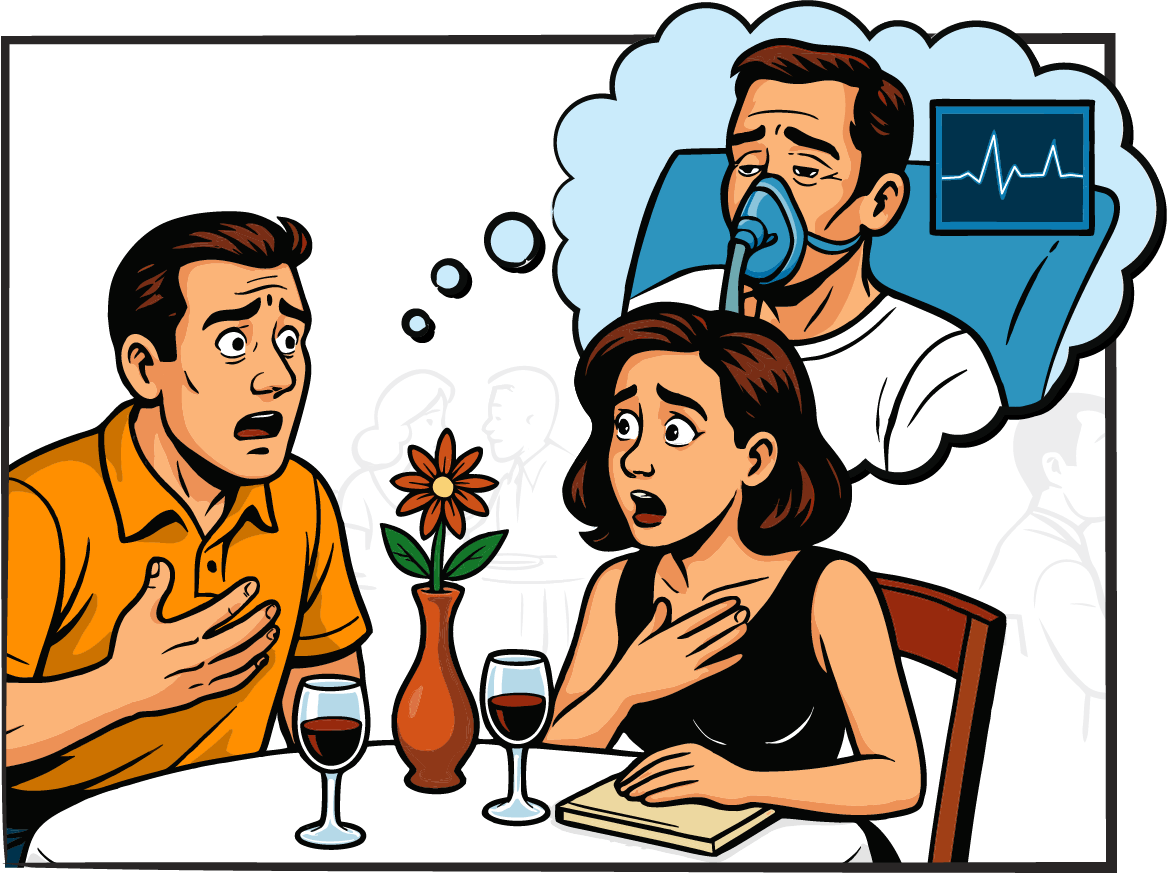

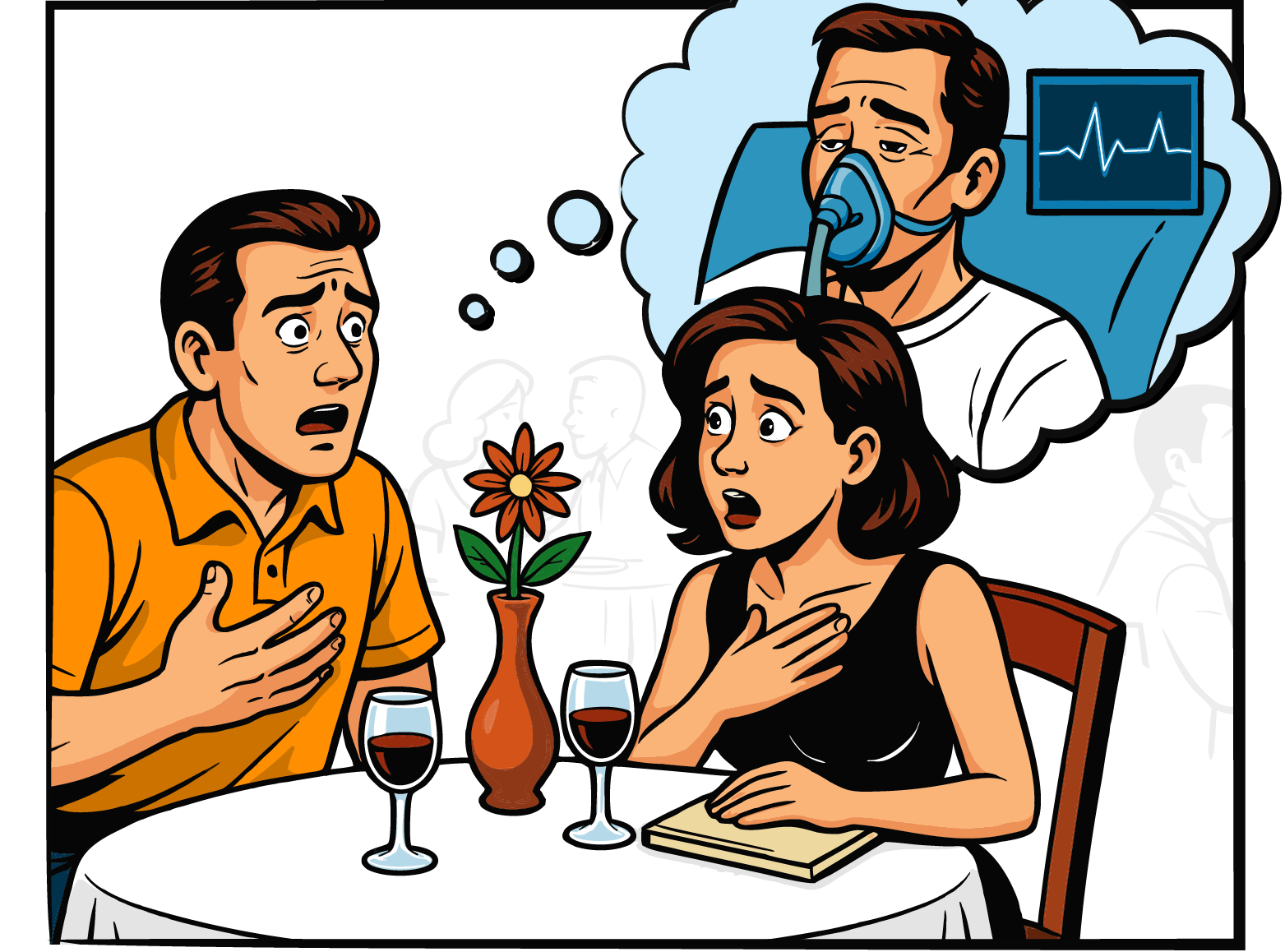

Defenders of rents

and repayments

When illness or death threatens to shatter an unsuspecting couple’s financial security, our heroes rise to shield their new home and safeguard their future!

Keeping families financially secure when a loved one dies or becomes terminally ill.

2 LIFE COVER OPTIONS

With low-cost Life Essentials and premier Life Protection, we have options to suit different needs and budgets.

PAYOUT PLANNER

Clients can nominate up to 9 beneficiaries during the application, so any payout bypasses probate.

ENHANCED TERMINAL ILLNESS

Our premier Life Protection pays out on certain terminal illness conditions regardless of life expectancy.

PREMIUM WAIVER AS STANDARD

If we offer someone cover, they automatically get Premier Waiver, regardless of their age, job or medical history.

Helping with the bills, when hard-working citizens find themselves too ill to work.

HIGH MAXIMUM COVER AMOUNTS

Clients can cover a maximum of 65% of their annual earnings up to £60,000.

THE POWER OF OWN JOB DEFINITION

Give your client the reassurance of knowing we pay out if they’re too ill to do their actual job.

WAIVER THAT PAYS OUT SOONER

We waive premiums after 28 days regardless the chosen Income Protection deferred period.

PAYOUT PERIOD OPTIONS

Build a policy that fits your clients’ needs and budgets with full-term or 2-year payout period options.

AND BECAUSE KIDS GET ILL TOO...

Our Children’s Critical Illness Protection can be added to any adult cover.

ADVISERS,

ASSEMBLE!

Catch up on our recent dynamic duo webinar recording and discover the power of our super cover.