1 May 2023

Income Protection increases resilience when living costs are high

The observation that many consumers continue to grapple with the cost-of-living crisis, which has depleted their savings and undermined their resilience, makes a compelling case for income protection.

Statistics from Kantar Profiles/Mintel in January 2022 showed that 59% of people would last less than 12 months without their income, and within that, 43% would be struggling within 6 months. Others could last a little longer but only 10% of the population wouldn’t struggle at all at some point.

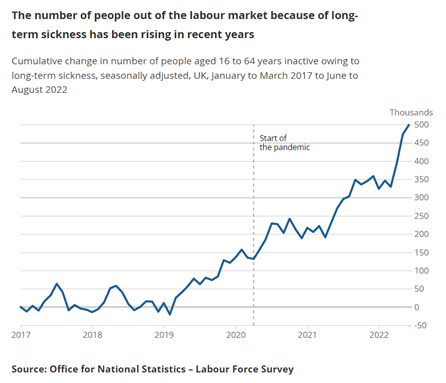

This income protection need is amplified by the findings of an ONS report published in November 20222. This pointed to a steady rise in long-term sickness absence since before the start of the pandemic, with half a million more people out of the labour force (*see chart) due to this since 2019. Between June and August 2022, around 2.5 million people reported long-term sickness as the main reason for economic inactivity, up from around 2 million in 2019.

The ONS report also showed the biggest increases were in the incidence of illnesses that are not necessarily within the scope of a critical illness policy. The report highlighted the biggest change was to ‘other’ illnesses (a rise of 41%), ‘problems connected with back and neck’ (a rise of 31%) and ‘mental illness and nervous disorders’ (a rise of 22%). This is compared to a 1% increase in the incidence of ‘progressive illness, e.g. cancer’.

So why is it that only 6% of people in the UK have an income protection policy? These statistics clearly show the need. Where does the problem lie? Lack of awareness or understanding? Perception that income protection is too expensive or doesn’t pay out? Too complex or just easier to buy life and critical illness cover?

We considered all of these when designing our new Income Protection cover. We started by looking at how to create more certainty at point of claim to dispel the myth that income protection policies don’t pay out. We did this by including an ‘own job’ definition. This not only means we’ll pay out if the customer can’t do their ‘specific’ job but it’s also a lot easier for the customer to understand what they’re covered for.

we’ve designed our new Income Protection to meet the needs of today; for people whose financial resilience has been hit by the cost-of-living crisis, but also where budgets are tight.

The industry use of ‘own occupation’ has been viewed by many as synonymous with ‘own job’ so the difference has been somewhat overlooked. But we don’t think it should be, as this difference is what can be the cause of disappointment for customers when they come to claim. People are more likely to understand they can claim on their policy because they’re unable to do ‘their job’ than be told they can’t claim because they’re still able to do a similar job within their class of occupation.

Take the example of a Packer whose work creates a dusty environment due to the nature of the materials used. If that policyholder develops asthma triggered by this environment, they can no longer work in that area. Under an ‘own occupation’ definition, they’re well enough to carry out another job within their occupation in another part of the warehouse where they wouldn’t be exposed to the dusty environment. So even if there are no current roles available for them to move to, their claim would be declined. Under our ‘own job’ definition, we’d pay the claim until a role could be found for them in an alternative team.

We believe this definition will also deliver good customer outcomes, which shows how we’re aligning with the FCAs Consumer Duty Principle 12 and delivering on rules within outcomes 3 and 4. We’ve also chosen not to offer terms where a claim is solely based on the ability to carry out ‘activities of daily working’ like bending or lifting, as these are typically difficult for the customer to make a successful claim under.

To address the problems around ‘too complex’ and ‘too expensive’, we asked advisers and consumers what they expected from an income protection policy. They told us: keep it simple. So, we stripped out all the ‘bells and whistles’ they said weren’t needed and added in some flexibility to suit different needs and budgets.

Customers can choose between 2-year and full-term payment periods and from a wide range of deferred periods, including 4, 8, 13, 26, and 52 weeks according to their needs and how much they want to pay. We cover 65% of annual earnings up to £60,000 a year. During the policy term we’ll provide yearly statements, so customers always know what they’re covered – and paying – for. And they can take advantage of our Guaranteed Increase Options and Lifestyle Promise. At claim, clients can choose between weekly or monthly payouts, as well as the day of the week or date of the month they want to receive their payout, to align with their regular direct debits and standing orders.

On top of that, we allow customers to add our optional Children’s Critical Illness Protection when they take out their Income Protection cover so they can financially protect their children. Even if they don’t have a critical illness policy themselves. And as with all Guardian policies, we’ve included Premium Waiver as standard with a 28-day deferred period – for everyone. So even if a customer has a longer deferred period and they’re not yet losing any income, we can start to support them from that point with our HALO claims service.

In short, we’ve designed our new Income Protection to meet the needs of today; for people whose financial resilience has been hit by the cost-of-living crisis, but also where budgets are tight.

Our thanks go to the many advisers who shared their views with us throughout our product design process, and we hope we’ve delivered a proposition that makes it easy for them to recommend and easy for their clients to understand. It also demonstrates to the FCA how collectively we’re delivering good customer outcomes.

Source

- Kantar Profiles/Mintel, January 2022.

- Office for National Statistics, Half a million more people are out of the labour force because of long-term sickness, 10 November 2022.

Related perspectives

28 April 2021

22 February 2021

If we improve our definitions, it’s not only new customers who can benefit

Jacqui Gillies

(Former) Marketing and Proposition Director