COVER UPGRADE PROMISE

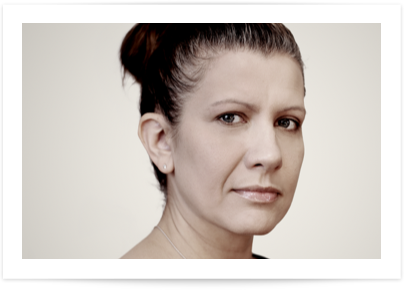

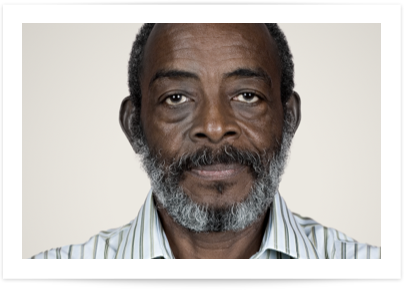

WHEN LEE’S HEART

FAILED HIM

SO DID HIS INSURER

It took a defibrillator to bring Lee back to life after a cardiac arrest. However, the policy Lee took out in 2007 refused to pay out. Apparently, his policy only covers heart attacks.

To make matters worse, in 2009 the insurer decided to include cardiac arrest in all new policies. But the improvement didn’t apply to existing customers like Lee.

So, he’s left with a pacemaker, medication for life and an outdated policy that let him down.

Lee is not alone

11 PROVIDERS HAVE MADE CHANGES TO THEIR CRITICAL ILLNESS COVER

40

TIMES SINCE 2018 WITHOUT UPGRADING EXISTING CUSTOMER’S COVER.

Source: From 1 January 2018 to 30 January 2025, ClExpert, February 2025.

THAT’S WHY, AT GUARDIAN, WE DO THINGS DIFFERENTLY

Every policy comes with a cover upgrade promise. This is our promise that if we improve our critical illness definitions for new policyholders, we’ll give those improved definitions to existing policyholders too. Usually, we’ll give these improvements to existing policyholders for free. If we can’t give policyholders them for free, we’ll give them the opportunity to pay to add these definition improvements to their cover.

REGISTER FOR A PRODUCT BRIEFING

To find out more about Guardian, join us at our next monthly product briefing with one of our experts.

Our webinars are designed for you to learn more about Guardian and give you hints and tips to grow your protection sales. All our live webinars qualify for CPD.