PREMIUM WAIVER

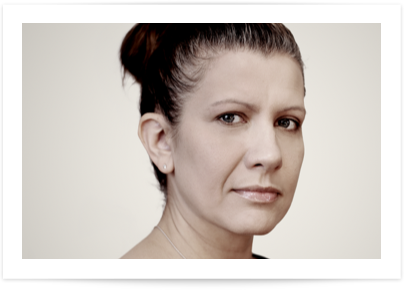

JO LOST HER JOB

AND CRITICAL

ILLNESS COVER

Jo lost her job as a chef. Money is now so tight that Jo’s been forced to cancel the critical illness policy she’s had for 10 years.

Jo plans to take out cover again when she’s back on her feet. But doesn’t yet realise that insuring herself again in the future will be much more expensive because she’s 10 years older.

Jo is not alone

124,000

PEOPLE WERE MADE REDUNDANT IN THE UK FROM NOVEMBER 2024 TO JANUARY 2025

Source: House of Commons Library, UK labour market statistics, 20 March, 2025.

THAT’S WHY, AT GUARDIAN, WE DO THINGS DIFFERENTLY

At Guardian, we understand that in certain situations money can get tight, and life would be a little easier if you could take a break from paying your premiums. So, if you become too ill to work, we’ll pay your premiums until you return to work. If you have a Life Protection, Critical Illness Protection, Combined Life and Critical Illness Protection or Income Protection, we’ll also also pay your premiums for up to 6 months if you’re made redundant or take maternity or paternity leave, as long as your policy has been in force for a year.

This is called Premium Waiver. Other providers offer it, but it’s an optional extra that you need to pay more for. With Guardian, it’s included as standard. For full details, view your policy terms and conditions.

The cost of cancelling cover and taking out cover again later in life:

Cost example

£100k of Combined Life and Critical Illness Protection:

Monthly premium if

cover is taken

out at age 35:

£44.24

V

Monthly premium if

cover is taken

out at age 45:

£85.70

Source: Guardian quote: female age 35 and 45, non-smoker, £100k

Combined Life and Critical Illness Protection, 25 years, 28 March 2025

REGISTER FOR A PRODUCT BRIEFING

To find out more about Guardian, join us at our next monthly product briefing with one of our experts.

Our webinars are designed for you to learn more about Guardian and give you hints and tips to grow your protection sales. All our live webinars qualify for CPD.